5 WAYS TO INVEST IN REAL ESTATE

WITHOUT OWNING YOUR HOME

Real estate is what’s known as a “real asset”, which means it provides a real benefit beyond any financial return on investment. For most people looking to buy their primary residence, it has much less to do with maximizing the financial return and more with finding a home that accommodates their lifestyle and budget. Nonetheless, because it provides real benefit, real estate is a relatively stable investment, with most Canadian homeowners seeing their net worth increase over the years due to their decision to own instead of rent. This promise of wealth creation through home ownership is well understood by most Canadians: over 6 in 10 Canadian families own their home while close to 70% of non-homeowner Canadian millennials view home ownership as important to them.

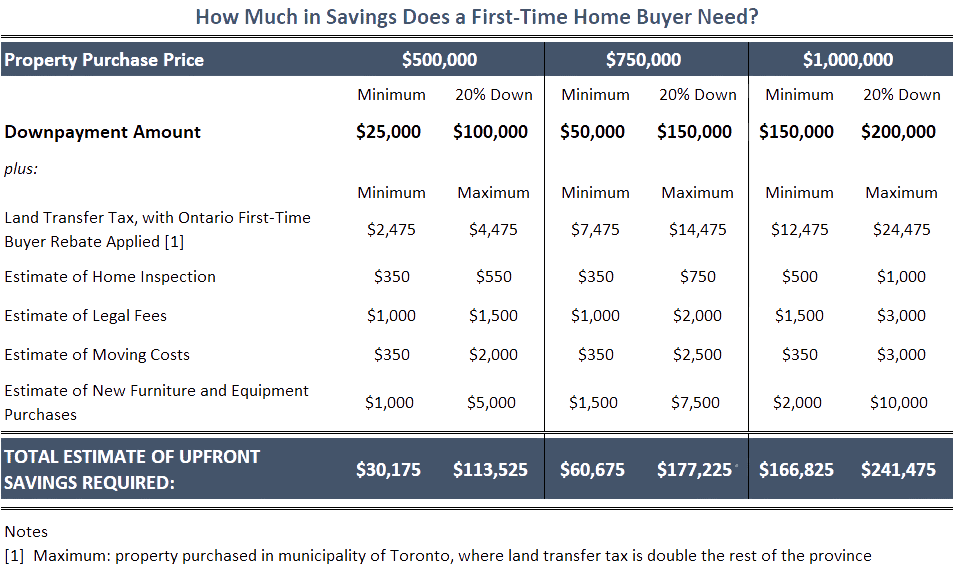

But like any asset, real estate has its downsides that must be considered before investing. First and foremost, it is capital-intensive, meaning you need to save up a lot of cash in order to buy your home. Many Canadians strive for a 20% down payment in order to avoid paying mortgage default insurance, which means if you’re buying the average resale home in Canada – priced at around $670K in the third quarter of 2025 – you need $135K in available savings. This only represents your down payment, with other upfront costs including but not limited to land transfer tax, a home inspection, storage and moving costs, legal fees, and new furniture purchases. Even if you could get approved at the minimum down payment, buying a home requires a large upfront spend, which is not the case when investing in stocks or bonds.

Beyond being capital-intensive, real estate is an active investment, meaning it requires ongoing work in order to maintain or improve upon its value. This relates to regular maintenance, such as seasonal housework and equipment upgrades in addition to unforeseen events, such as floods, fires, and pest infestations. If you are handy and have the time to do the work, you can save thousands in ongoing active management expenses. However, many of these costs cannot be avoided and when tacked onto your monthly mortgage payment, property taxes, utilities, and insurance, they can put a serious strain on your ability to save money for your other lifestyle goals and entrepreneurial pursuits. When compared to passive investments such as stocks and bonds, investing in real estate requires significant time and effort in order to ensure success.

For many Canadians, particularly those just looking to get started on their real estate journey, these two downsides can pose significant barriers to entering the market. Thankfully, owning your home is merely the traditional way to invest in real estate, with many alternatives available to those renting today. In this article, we’ll outline five ways to invest in real estate without owning your home, along with a few suggestions and considerations to keep in mind.

1) Buy an Investment Property

When you buy a home for the purpose of living in it, you severely limit the income potential of your asset. While some homeowners choose to Airbnb their property for the purpose of earning additional income, you can only do this for 179 days a year and also have to deal with the headache of constantly moving in and out of your house. Alternatively, you can rent your primary residence and pool your available savings to put towards a full-time investment property. By doing so, you can cover the ongoing costs of your investment through the rents earned from the property.

No two investment properties are the same and some will be better suited to your personal circumstances. For example, if you aren’t handy or don’t have the time for property management, investing in a condo is more likely the right choice for you. Yes, you will have to pay a monthly condo fee, but this fee will cover certain elements of property management and in general, condos require less ongoing upkeep when compared to single-family detached properties. If you choose to go down this route, it’s important to work with your realtor to understand which condo may be the best fit for you, as some do not allow rentals of any kind while other condo corporations may not be financially or structurally healthy, requiring steep increases to their condo fees over time.

Keep in mind that investing in a rental property is just as capital-intensive as buying your own home. However, an investment property does not need to be solely funded by you. By partnering with multiple team members, you can acquire a property with much less required from you upfront. There are many ways to structure a partnership agreement, and beyond the sharing of upfront and ongoing property costs, a well-rounded team will often assign roles to team members based on their personal strengths, such as accounting and financial management, tenant relations and marketing, and property upkeep.

2) Invest in Real Estate Agents

Real estate agents directly participate in the housing market through sales commission, which is typically paid out as a percentage of the property’s sale price. Over time, the average commission rate has held fairly steady at around 4 to 5 percent of the sale price, meaning that realtors have seen their commission income grow at a similar pace to home prices. When compared to wage growth or inflation, real estate sales volume – and subsequently commissions – has experienced excess growth in Canada over the past decade.

Even if you’re not a realtor, you can still participate in the growth of commissions by investing in real estate companies, some of which are publicly traded on the stock market. Real estate brokerages employ agents as independent contractors, earning a share of the commission they generate. Every brokerage has a different business model, often having multiple agent compensation plans in place depending on the type of agent (rookie, experienced, or top-producer). Further, some companies are traditional long-standing brands while others are focused on leveraging technology to drive innovation for real estate agents and the customers they serve. Below are four publicly-traded companies that you could invest in today, along with some of their strength and weaknesses. This is not investment advice – investing in individual stocks can be risky, and any stocks you choose to invest in should match your risk tolerance, stage of life, and overall investing strategy.

Anywhere Real Estate

Ticker: HOUS

Business Model: Traditional Brokerage and Franchise System

Anywhere Real Estate, formerly Realogy Group, owns multiple long-standing real estate brands such as Sotheby’s, Coldwell Banker, and Century 21. In total, across both its franchise and corporately-owned offices, the company ended 2024 with just over 310K realtors under its roof, which represents one of the largest realtor networks in the world. With a market valuation of roughly 1.1 billion USD, Anywhere Real Estate (“HOUS”) is what’s known as a value stock, which means it is discounted relative to its sales and net assets. HOUS currently has a trailing price-to-sales (“P/S”) ratio of 0.19, which means that for each dollar of revenue earned, you only need to pay 19 cents to acquire. Its price-to-book (“P/B”) is similarly discounted at only 0.74, which means you only need to pay 74 cents for each dollar of net assets that HOUS owns. Investors are noticing this value: multiple expansion has occurred since 2023 when HOUS was trading at 0.08 P/S and 0.3 P/B. Nonetheless, compared to “tech-enabled” real estate brokerages like eXp Realty or Redfin, HOUS is significantly cheaper to invest in if you’re looking for exposure to realtors and the commissions they earn.

Keep in mind that with any discounted company, they are discounted by the market because of apparent or perceived risks associated with investing in them, such as the fear that technology will replace the traditional real estate agent or that the company has too much debt relative to its profits. Anywhere Real Estate suffers from both of these risks, although in recent years it has restructured its balance sheet and brought its operating cash flow back into breakeven and positive territory.

Re/Max Holdings

Ticker: RMAX

Business Model: Traditional Franchise System

Founded in 1973, Re/Max is a leading American brand, ending 2024 with 146K agents in its network. With offices in 110 countries, Re/Max has the largest global footprint amongst real estate companies, although the majority of its agents are based in the US and Canada. Re/Max operates a franchise business model, which means it earns a small “head-office” fee from each of its independently owned and operated real estate and mortgage offices. This makes their gross margin much better than brokerage companies like HOUS or Redfin, which have significant operating costs tied to providing service to their agents.

With a valuation of 440 million USD in October 2025, RMAX is worth less than half of HOUS with a much higher P/S ratio of 0.62. Not all sales dollars are created equally. Investors pay a premium for stable profits in the form of royalty fees, which is what Re/Max has through its franchise business model. However, challenges associated with the legacy real estate brand still exist. In November 2023, Re/Max suspended its dividend, citing the need to preserve capital amid a challenging housing and mortgage market as well as a litigation settlement.

Opendoor Technologies

Ticker: OPEN

Business Model: Disruptor Brokerage with Alternative Seller Offer

Opendoor is one of the pioneers of the Instant-Offer or “iBuyer” model, which originated in the American South-West around 10 years ago. In reality, this model has been around for as long as homes have been bought and sold: I will give you an all-cash offer to buy your home right now, as-is. That’s basically what Opendoor does, although the company has refined and improved the model through its use of technology. After the stock cratered from its pandemic highs in 2021, it has become one of the trending tech stocks of 2025, up 370% year-to-date. As of October 2025, the stock is still down 67% over the past five years, reflecting the risk associated with its capital intensive business model.

Unlike HOUS or Re/Max, Opendoor does not promote its individual agents. Rather, customers work directly with Opendoor to receive their all-cash offer and arrange for an optimal closing date. Because of the convenience provided by this Instant-Offer service, which does not require you to list your home while living in it, sellers pay a premium when compared to traditional listing fees of 4 to 5 percent. Once Opendoor buys the home, it aims to implement some minor repairs and improvements before re-selling it within the following 3 to 6 months. This model is significantly more risky than the revenue earned from Re/Max or a traditional real estate brokerage, as it involves buying a property which may be subject to a market downturn. This explains why Opendoor has much thinner gross margins and overall profitability than its traditional brokerage competitors. Nonetheless, with a recent valuation of just 5.5 billion USD at a P/S ratio of 1.1, the market is currently more optimistic in Opendoor’s future than it is for legacy players like HOUS or Re/Max.

Redfin

Ticker: RKT (Acquired by Rocket Companies)

Business Model: Disruptor Brokerage with Consumer Discount Offer

Redfin operates a popular real estate website in the United States, while also providing realtor services to buyers and sellers at discounted commission rates. The company claims that its proprietary technology not only provides better insights and an unmatched consumer experience, but that it allows for realtor services to be delivered at a lower cost. Unlike most brokerages, which employ realtors as independent contractors, Redfin realtors are on a salary plus bonus compensation model. This helps ensure a base level of service that you can expect from any Redfin agent, although traditional brokerages would argue that the salaried model removes the incentive for realtors to hunt for new business or deliver superior client service.

A public standalone company for almost 8 years, Redfin was acquired by Rocket Companies in March 2025 in an all-stock transaction. With a valuation of 36 billion USD at a P/S ratio of 0.6, Rocket Companies is a large proptech player best known for its mortgage business. So if you believe Redfin's salaried realtor model with consumer discount proposition is the way of the future, you can get exposure through buying shares of Rocket.

3) Invest in Landlords

As you may have noticed from the previous section, there is significant innovation and technological disruption occurring in the realtor business. One area of real estate that is more stable relates to the companies who own and manage apartment buildings and other rental properties. Many of these companies are known as REITs (“reets”), which stands for Real Estate Investment Trusts. As the name implies, REITs are generally more stable than standard publicly-traded companies, with a trust structure that ensures that most of the business income is paid out to shareholders as dividends. The model is fairly simple: the REIT charges rent to their tenants and, after covering property management and operating expenses, they return a portion of the business income to their shareholders. Most REITs pay out their dividends quarterly, although some offer monthly dividends which provide even smoother cash flow for retirees and other fixed-income investors. If you don’t have enough money, time or available business partners to buy an investment property, a well-balanced REIT is a great alternative. Similar to a rental property, you can earn operating income through dividends (i.e. rent for investors) while also participating in any stock price gains recognized by the REIT over time.

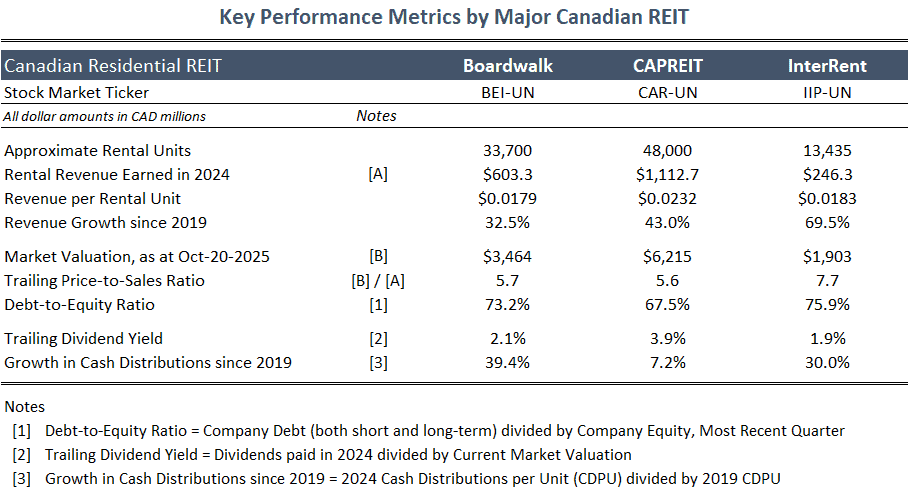

It’s important to note that you can buy a REIT for more than just residential properties. Some REITs are entirely commercially-focused, with many invested in a particular sector such as offices, shopping centres, or industrial parks. However, if you want to place your bet on Canadian home prices going up, and with them rising rents, stick to residential REITs. Here are 3 Canadian residential REITs that I track closely.

Boardwalk REIT

Ticker: BEI.UN

Primary Geography: Alberta

As of year-end 2024, Boardwalk REIT operates 33,700 rental suites across 200 communities in Canada. More than half of its current rental portfolio is based in the Greater Calgary and Edmonton areas, two leading Canadian markets that are significantly more affordable than home prices in Ontario or British Columbia. Its next largest markets are Montreal and London Ontario, two cities that have experienced strong price growth in recent years but are still more affordable than the surrounding GTA. If you believe these smaller metros will see prices grow at a faster rate than expensive cities like Toronto and Vancouver, investing in Boardwalk will give you great exposure.

In 2024, Boardwalk generated just over 600 million in total revenue, up 32% from 2019 levels. The company is valued at $3.4 billion CAD in October 2025, which equates to a trailing-12-months ("TTM") P/S multiple of 5.7.

CAPREIT

Ticker: CAR.UN

Primary Geography: GTA

CAPREIT, or Canadian Apartment Properties, is the largest Canadian REIT, with 45,000 rental suites across Canada and an additional 3,000 in the Netherlands as of year-end 2024. Close to half of its current rental portfolio is based in Toronto and the surrounding GTA, with another 9% based in Vancouver. Unlike Boardwalk, the company has little presence in Alberta and the Prairies, with less than 5% of its portfolio based in the region. If you are betting on continued low vacancy rates and rising prices in our most expensive Canadian cities, CAPREIT may be a good choice for you.

In 2024, CAPREIT generated just 1.1 billion in total revenue, up 43% from 2019. The company is valued at $6.2 billion CAD in October 2025, which equates to a TTM P/S multiple of 6.3.

InterRent REIT

Ticker: IIP.UN

Primary Geography: GTA

With 13,435 rental suites at year-end 2024, InterRent is a smaller player than Boardwalk or CAPREIT. The company is primarily based in Toronto, Ottawa-Gatineau, and Montreal, with these 3 metros accounting for 78% of its current rental units. Beyond those markets, InterRent owns 2,007 additional units throughout Ontario as well as 866 suites in Vancouver, giving the company a heavy exposure to the Windsor-Quebec corridor. If you believe a smaller player can grow faster or more efficiently than a more established REIT, InterRent is a great choice.

In 2024, InterRent generated 246 million in total revenue, up 70% from 2019. The company is valued at $1.9 billion CAD in October 2025, which equates to a TTM P/S multiple of 7.6.

4) Explore Alternative Living Arrangements, such as Rent-to-Own

The housing affordability crisis in Canada requires a range of solutions, with rent-to-own properties representing one way for prospective buyers to earn their way into a down payment. If you don’t currently have meaningful savings but are hardworking and earn a consistent monthly income, keep an eye out for rent-to-own offers in your area. Instead of paying “market-rate” rent for the property, you will pay a little bit more, with that extra money contributing towards your downpayment over time.

Rent-to-own is not standardized or widely available in Canada, but it is gaining prominence as property owners and tenants alike look for creative ways to work together. The selling side of a rent-to-own arrangement benefits from a locked-in sale price in addition to receiving above-market rents and peace of mind knowing that the tenant is motivated to treat the home as if it were their own. For the tenant, they can begin building equity in the property today while working towards their eventual downpayment. In most cases, the property for sale is purchased on the open market by a rent-to-own investment company, who then enters into a rent-to-own agreement with the future owner.

Every rent-to-own contract is different, with two prominent Canadian companies that work in the space being Clover Properties and Rent-to-Own Canada. These companies offer alternative financing to help you secure your home today, with the aim that you will have paid enough excess rent to qualify for your own mortgage within 2 to 4 years. As always, be sure to review any rent-to-own offer with a lawyer to ensure that the arrangement has been structured in good faith and fits within the context of your financial plan.

5) Invest in Fractional Home Ownership

Last but not least, the rise of internet crowdfunding has provided innovative new ways for people to raise money and gain access to investments they could not afford on their own. With fractional home ownership, property management companies pool money across hundreds of investors for the purpose of acquiring and managing a rental property. In many cases, you can invest in a property for less than $1,000, which is much easier to achieve in the short-term when compared to a home purchase.

Unlike investing in a publicly-traded REIT, fractional home ownership gives you greater control of which specific property or neighbourhood you’d like to invest in. Its primary downside is that your money is typically tied up for a minimum period, whereas REITs and other stocks can be traded on a daily basis. However, investing in real estate is a long-term game, so if you want to get started building equity in a property today, investing through fractional ownership companies represents a passive and cost-effective way to do so.

Three prominent companies offering fractional home ownership are Addy, Roofstock, and BuyProperly. Addy, a leading Canadian player with recent expansion to the United States, allows its members to invest between $1 and $2,500 in its available properties. Roofstock is a major American player, with over $5 billion in sales volume since launch and a variety of financial and property management tools available to its fractional investors. Finally, BuyProperly is active in both Canada and the US, with a minimum investment amount of $500, recommended holding period of 5 years, and annual management fee ranging from 1% to 2.5% of your total investment. Across each investment opportunity and fractional ownership company, investing terms and fees will differ slightly, although the key benefit stays the same: increased access and simplicity to invest in multiple properties and neighbourhoods of interest.

Summary

There are many ways to invest in real estate without owning your primary home. Depending on your amount of available savings, ability and time available for active property management, and how long you want to invest your money, some alternatives will be better suited to you than others. In any event, building wealth through real estate is not limited to buying the home you plan to live in, with many financial and lifestyle advantages offered by renting. Check out our article and supporting calculator on Renting versus Owning to learn more, and please don’t hesitate to reach out if you have any other questions.

Thank you for taking the time to read this article. As you contemplate the next steps in your real estate journey, there are a variety of helpful online resources you can leverage, such as realtor.ca, the Canadian Mortgage and Housing Corporation, and historical sales data and market insights from real estate websites like Zolo, Wahi, HouseSigma, and Royal LePage.

ABOUT THE AUTHOR

John Peloza has held his Ontario Realtor® license since April 2021 and has held the Chartered Financial Analyst® designation since 2018. Upon graduating from the Ivey School of Business, John spent time in market research and consulting roles before beginning his career in real estate in 2017 as a Financial Analyst with Royal LePage Canada. During his time at Royal LePage, he supported on consulting engagements with parent company Brookfield, culminating in a secondment at digital brokerage start-up Wahi, which has been based in Toronto since November 2021.

John's primary markets of interest include the Toronto harbourfront, Liberty Village and Queen West neighbourhoods, his hometown of London Ontario, and the Leamington-Kingsville region of Essex County. He is passionate about real estate, wealth management and personal investing, and helping clients achieve their goals through education and expertise.