An opinion piece based on historical transaction data from each of Ontario's real estate boards

Ontario Provincial Overview

Updated through the fourth quarter of 2024

Ontario is the largest and fastest-growing province in Canada, representing almost half of our national population and expected to surpass 20 million people over the next 25 years (37% forecasted growth). The bulk of the population is currently located in southern Ontario, specifically the Quebec-Windsor corridor which is centered by the GTA. If you don’t know what the GTA stands for, you’ve got a lot to learn.

Real estate is what’s known as a real asset, which means it provides benefit beyond any financial return on investment. That’s why we are so fortunate to live in this country; not only do we get to live in one of the most beautiful, free places in the world, Canadian homeowners have and will likely continue to enjoy a relatively low-risk but healthy return on their investment. This is no secret, explaining why close to 70% of non-homeowning millennials consider home ownership as important to them, with half of all Canadian millennials planning to purchase a home within the next 5 years.

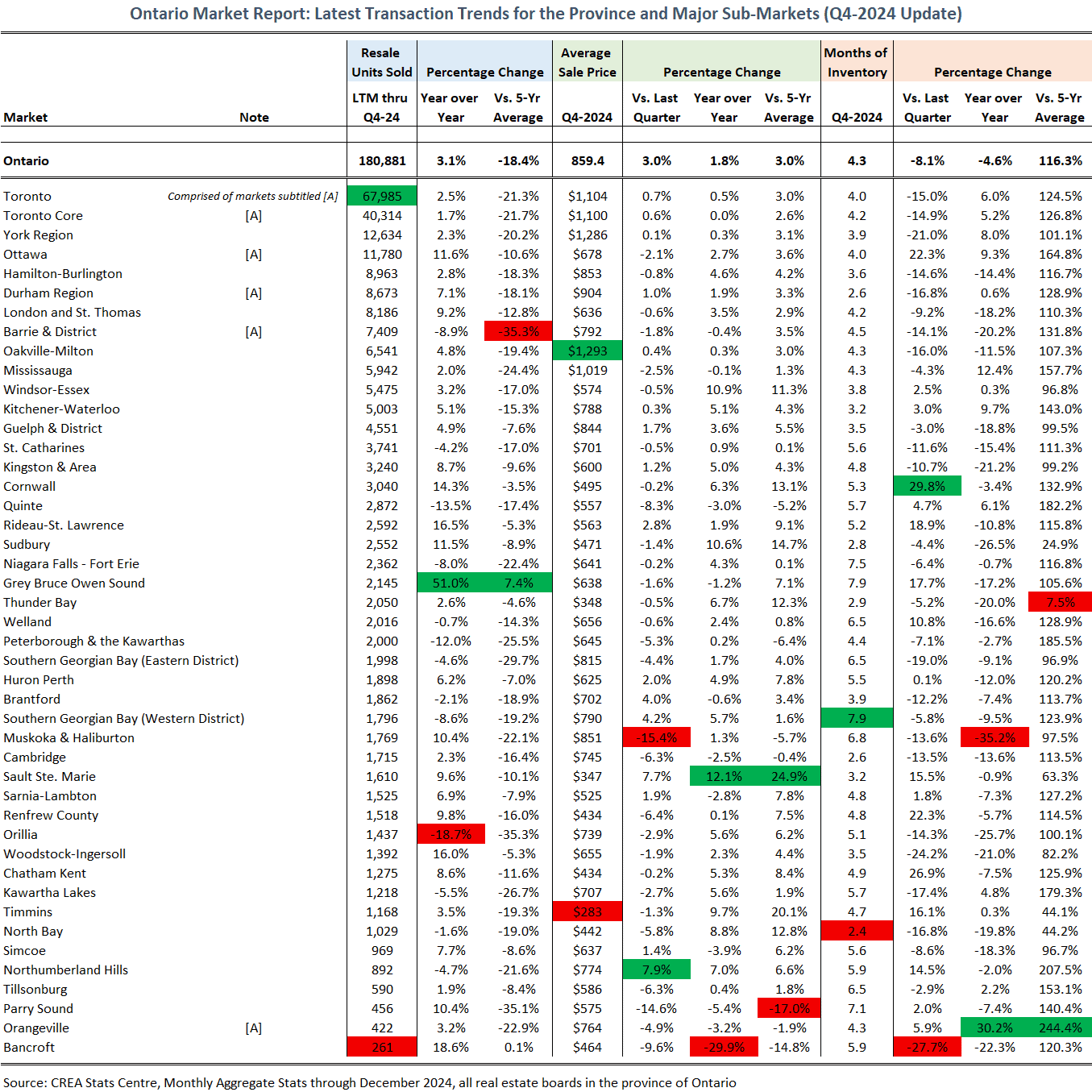

As mortgage rates rose aggressively in 2022, our red-hot housing market has gone through a pricing correction and material slowdown in sales activity. With inflation now relatively under control, multiple rate cuts have been implemented but sales activity remains slower than expected. The average resale home price in Ontario ended the year at $859K, up 3% from the summer quarter and up 2% year-over-year. With many buyers holding out for improved affordability, overall units sold in 2024 is down 18% from the trailing 5-year average (2019 thru 2023). To end the year, average resale prices are up year over year in most markets in Ontario, with the provincial average up 36% when compared to 5 years ago (Q4-2019). After declining to start the year, resale inventory climbed for seven straight months as motivated sellers continue to list their properties at a faster rate than buyers are transacting. To end the year, the province recorded 4.9 months of inventory, reflecting fairly balanced or buyer friendly conditions in the historical context. As we begin 2025, mortgage renewals from pandemic-era rates (and prices) may continue to aid in the current buyers market, as some homeowners may not be able to renew their covid-era mortgage at higher rates. At 5.0 months of provincial resale inventory recorded in September, Ontario buyers have not had more inventory to choose from since January 2014.

Almost one in four people counted during the 2021 census are or have been a landed immigrant or permanent resident in Canada. This was the highest proportion since Confederation and the largest proportion among G7 countries, with Canada expected to welcome almost 1.9 million new permanent residents between 2022 and 2025. According to Statistics Canada's recent population projections, immigrants could represent from close to one-third of the total population by 2041. There is significant demand across the world to come to Canada, and there is urgent need for municipal and provincial governments to invest in affordable housing initiatives aimed at Canadian renters and first-time homebuyers. Increased political pressure has resulted in the federal government announcing a cap on international student permits, amongst other measures such as the previously announced foreign buyer ban. These measures are intended to reduce demand but unfortunately do not represent a sustainable long-term solution for our inadequate supply of homes. Other affordability measures recently announced by the federal government include the introduction of a 30-year mortgage as well as a 50% increase on the cap for insured mortgages requiring a 20% downpayment.

The Canadian Real Estate Association (CREA), through its various real estate boards and provincial associations, compiles transaction data for each of its major markets, with the CREA Stats Centre reporting sales data going as far back as 1980. While historical stats should never be the sole indicator of what’s to come, they are helpful to review and consider as part of the broader context. In this article, we will provide an update on our 5 favourite real estate markets in Ontario, alongside historical results for each Ontario market tracked by CREA.

Toronto

Toronto is the largest city in Canada and the economic and entertainment hub of our country. It is one of our most livable cities, although high home prices continue to put it at a disadvantage to other world-class Canadian cities such as Montreal and Calgary. Nevertheless, with strong immigration levels into our country and a growing population, Toronto and the surrounding GTA will continue to be a major destination.

Historically, this is why Toronto typically reports lower Months of Inventory (i.e. housing supply) than other Ontario cities. Months of Inventory (MOI), which measures how many resale homes are available for sale relative to buyer demand, is a statistic tracked by CREA to infer how hot a real estate market may be. A lower MOI means that the number of homes available are quickly being purchased by the many more buyers that exist in the market. Going back all the way to 1994, Toronto has a median MOI of 2.8 months, compared to the province of Ontario which has a median of 3.8 months of homes available for sale.

When your market has lots of demand, you need to have lots of people selling or lots of new homes being built. Toronto has neither of these when compared to the overall demand to live in or nearby the downtown core. Add in the fact than many neighbourhoods in Toronto have limited space for new development, such as Liberty Village, and it is evident that housing affordability will continue to be a big issue for the city. After a strong start to the year where inventory in the GTA fell below 2 months, many new sellers entered the market with resale inventory spiking for six straight months to finish the year at 4.6 months. It appears that some sellers have been waiting for rate cuts to list their homes, with a glut particularly in condo listings at double the supply when compared to the trailing 5-year average.

During the final quarter of 2024, the Greater Toronto Area reported an average sale price of $1.1 million, more or less flat from a year ago and only up 3% from the trailing 5-years which are now centered on the Covid market peak in 2021. Across all regions comprising the GTA (York Region, Mississauga-Peel, Halton, Durham, etc.) the core Toronto municipality, which suffered somewhat of an exodus during the pandemic, remains challenged for price growth despite featuring more inventory than the historical average. For more information on the Toronto housing market, specifically the Toronto municipality comprising Etobicoke and Scarborough boroughs, check out the latest Toronto Market Report here.

London

London has a few reasons why it’s on this list. Two hours west of the GTA, two hours east of Windsor-Detroit, and 45 minutes from two Great Lakes, London is the hub of southwestern Ontario, with major companies, hospitals, and higher education based in the city. Across Western University and Fanshawe College, London’s population grows by 50,000 students every September through April, with many of these students choosing London as their new home upon graduation. This is a big reason as to why the London rental market has historically been one with very low vacancy rates, with a recent Statistics Canada report showing 86% of all apartments in London being owned by investors. This is significantly higher than what the report found for nearby markets of Kitchener-Waterloo (61.5% investor-owned) and Toronto (36.2%). London is a large and fast-growing market, the 11th largest in Canada, with its population up 10% since the 2016 census. This population increase is close to double Ontario provincial growth of 5.8% during the same time period. As affordability across the GTA becomes more and more out-of-reach for first-time buyers, London should continue to see increased demand driven by GTA migration.

In the final quarter of 2024, the London and St. Thomas board reported an average sale price of $636K, down 1% from the prior quarter and up 3.5% year-over-year. When compared to trailing 5-year average, now centered around the market peak of 2021 and early 2022, London prices are only up 3%, in line with the provincial average.

At the end of 2023, London reported 4.7 months of inventory, slightly higher than inventory levels one year earlier and much healthier than the trailing 5-year average for the region. Like other markets in Ontario, inventory has risen sharply since April and now sits in buyer-friendly conditions at just under 5 months of supply.

For more information on the Greater London Area, comprising London and surrounding Middlesex County, St. Thomas and Elgin County, Strathroy-Caradoc, Woodstock-Ingersoll, and Tillsonburg and Norfolk County, check out the latest London Market Report here.

Thunder Bay

Thunder Bay, like London and Toronto, is the hub of its greater region of Northwestern Ontario. While not home to nearly as many people, it should continue to grow in prominence alongside other hub cities in Canada. For those who don’t know Thunder Bay, it is the major city on Lake Superior, with its vast waterfront and surrounding nature making it one of the most spectacular landscapes in our country. It is also known for its harsh winters, but if you’re a fan of the great outdoors, Thunder Bay has a lot to offer. As a hub city, Thunder Bay’s economy has a mix of manufacturing, primarily relating to the area’s vast natural resources and lake access, and services such as healthcare, banking, and education. It is home to two premier Canadian post-secondary institutions: Lakehead University and Confederation College, with Lakehead recently expanding into southern Ontario with a permanent satellite campus in Orillia.

A final reason it is on my list of favourite markets in Ontario is its relative affordability. Thunder Bay is more remote than southern Ontario: 1 hour from the Minnesota border but more than 7 hours to its nearest Canadian cities of Winnipeg and Sault Ste. Marie. For this reason and its harsh winter climate, average prices in Thunder Bay are now around $348K. When considering that summers in Thunder Bay can get as hot as anywhere in southern Ontario, the chance of trading in your beautiful, but small, Muskoka cabin for your dream recreational property, you can understand why many people are relocating to Thunder Bay or considering doing so. This is all made more possible with the Covid-19 acceleration towards the hybrid-work model of the future.

Back in 2022, Toronto, London, and most markets in Southern Ontario saw price declines while average prices in Thunder Bay were more or less flat. In 2023 and extending throughout 2024, buyer demand driven by relative affordability has remained strong with inventory levels still in line with Thunder Bay’s trailing 5-year average of around 3 months of supply. Since April, most cities in Ontario are reporting rising inventory levels into buyer-friendly territory, but Thunder Bay has bucked the trend. During the last quarter of the year, Thunder Bay reported 2.9 months of resale inventory, 30% lower than the provincial and GTA averages for the same period.

Prices in Thunder Bay continue to outperform the GTA and the province in 2024, finishing the year up 12% from the trailing 5-year average. Year over year, Thunder Bay average resale prices are up 7%. As our country continues to grow, it will be interesting to track Thunder Bay's progress as a more prominent Ontario hub market.

Cornwall

Cornwall is the smallest market on this list, with a population of just under 50,000 as of the 2021 census. However, in the broader context, it is surrounded by multiple large - and more expensive - markets. Montreal is a 90 minute drive, while Ottawa is just over an hour away. When compared to regular GTA traffic, those commutes are not unreasonable.

Beyond Montreal and Ottawa, 5 hours to the west is the GTA, while 7 hours south lie the Boston and New York metros. These 5 population centres are home to more than 35 million people, and many of them will consider relocating at some point in their lifetime. They are also fantastic places to visit for those in Cornwall that aren’t opposed to a few hours of driving.

If the big city isn’t your preference, Cornwell locals are less than 3 hours away from the beautiful villages of Mont-Tremblant and Prince Edward County. From a lifestyle perspective alone, there is a lot of attraction within a short to medium weekend drive.

Long-term, Cornwall’s strategic location will place upward pressure on its relatively small housing supply. This has already been happening to a certain extent, with average resale prices in Cornwall significantly outpacing the provincial average over the last 5 years. When compared to the weighted average resale price over the past 5 years, Cornwall is up 13%, while the Ontario provincial average is only up 3%. Despite the pullback from the record peak observed in early 2022, Cornwall prices are still up 78% compared to five years ago, more than double the Ontario average of 37%. Even when factoring in this recent growth, Cornwall prices remain extremely affordable for southern Ontario, ending the year with an average price of $495K. This bodes well for its future growth.

In 2023, Cornwall performed in line with the province, with prices flat year-over-year. In 2024, buyer demand has picked up, with resale prices increasing in each of the first three quarters to finish up 6% year-over-year. While inventory levels remain lower than the provincial average, at 5.3 months in the fourth quarter, Cornwall buyers have more than double the resale supply to choose from when compared to the trailing 5-year average. With significantly better affordability than neighbouring cities, these favourable buyer conditions are not likely to last long as rate cuts intensify.

Ottawa

Ottawa, alongside Gatineau in Quebec, forms the National Capital Region. The two cities are home to the federal government and a multitude of public-sector organizations. With a population of 1.5 million, it is one of the largest and fastest-growing markets in Canada, with close to 10% growth since the 2016 census. As our country continues to grow and become more prominent on the world stage, this market should continue to benefit from its robust service-based economy.

Ottawa is two hours from Montreal, but as my friend Dylan likes to mention every time I come visit, Ottawa is a world-class entertainment city of its own. The city is home to multiple post-secondary institutions, professional sports teams, and is a short-drive from beautiful landscapes and freshwater lakes in nearly every direction. For these reasons and many others, Ottawa prices are up 50% compared to 5 years ago.

In the third quarter of 2024, the Ottawa board reported an average sale price of $685K, down 3% from the prior quarter but flat year-over-year. Like most markets in Ontario, Ottawa reported a sizable increase in inventory in the second half of 2023 that declined sharply to start the new year. However, inventory has risen for five consecutive months to finish the third quarter at 3.7 months of resale supply, slightly higher than supply levels from a year ago and double its trailing 5-year average.

Other Notable Highlights

Since March 2022, the sharp rise in interest rates has resulted in falling average prices and more balanced inventory levels. In 2022, only 5 Ontario markets had positive growth in their average resale price, with most of them being hub cities in more remote regions of Northern Ontario (Thunder Bay, Timmins, and Sault Ste. Marie, alongside Sarnia and Kingston). During 2023, prices stabilized, with only 10 of 45 provincial board regions reporting year-over-year price declines. Stabilized prices have continued in 2024, with only 11 of 45 markets down year-over-year, 10 of which saw minor declines of less than 6%.

Another general trend for Ontario and the entire country: prices are up significantly when compared to pre-pandemic. It is relatively easy to pick your favourite market when most are appreciating long-term on account of excess demand. In Ontario, every board region ended the final quarter of 2024 with a higher sale price than what was recorded five years ago in Q4-2019. Across the province, the smallest increase over the past 5 years was recorded in Toronto, up 27%. The largest 5-year gain is in Sault-Ste Marie, with resale prices nearly double (+95%) when compared to the end of 2019.

Every market is different, but understanding available inventory levels alongside recent price and market trends can help prospective buyers and sellers make more informed decisions. A summary of all Ontario markets through the final quarter of 2024, sorted by largest to smallest for overall units sold, is presented below. Stay tuned for the Q1-2025 update of Ontario Market Report in April.

At Royal LePage, we are the largest Canadian real estate company, with close to 20,000 licensed realtors across the country. In Thunder Bay, Royal LePage Lannon is the market leader, advising on more than 30% of all transaction volume and recently winning the A.E. LePage Brokerage of the Year award. If you are looking to learn more about a particular market, historical transaction stats coupled with an agent specialized in your property type and location is a great way to do so.

Thank you for taking the time to read this article. As you contemplate the next steps in your real estate journey, there are a variety of helpful online resources you can leverage, such as realtor.ca, the Canadian Mortgage and Housing Corp, and historical sales data and market insights from leading real estate websites like Zolo, Royal LePage, HouseSigma, and Wahi.

ABOUT THE AUTHOR

John Peloza has held his Ontario Realtor® license since April 2021 and has held the Chartered Financial Analyst® designation since 2018. Upon graduating from the Ivey School of Business, John spent time in market research and consulting roles before beginning his career in real estate in 2017 as a Financial Analyst with Royal LePage Canada. During his time at Royal LePage, he supported on consulting engagements with parent company Brookfield, culminating in a secondment at digital brokerage start-up Wahi, which has been based in Toronto since November 2021.

John's primary markets of interest include the Toronto harbourfront, Liberty Village and Queen West neighbourhoods, his hometown of London Ontario, and the Leamington-Kingsville region of Essex County. He is passionate about real estate, wealth management and personal investing, and helping clients achieve their goals through education and expertise.