London Market Report

2023 First Quarter Update

An overview of historical transaction data in the Greater London Area

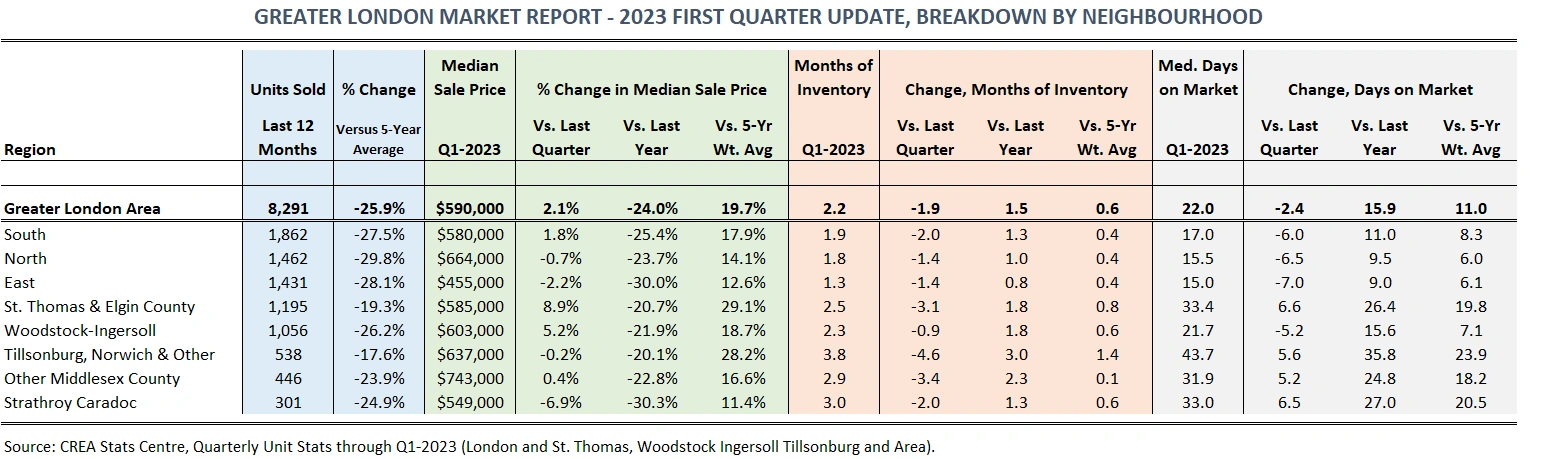

In 2022, the Greater London Area, like other real estate markets across the country, saw a significant decline in sales activity. Overall resale units sold were down 20% when compared to its trailing 5-year average. As expected, the trend worsened during the first quarter of the new year, with overall sales activity down 38% when compared to the record quarter one year prior. The Canadian Real Estate Association (CREA), through its various real estate boards and provincial associations, compiles transaction data for each of its major markets, with the CREA Stats Centre reporting sales data going as far back as 1980. While historical stats should never be the sole indicator of what’s to come, they are helpful to review and consider as part of the broader context. In this first quarter update, we'll outline transaction trends for each of the communities comprising the Greater London Area, as well as overall performance by property type.

Greater London Area: Regional Overview

London, the seat of Middlesex County, is the largest city in southwestern Ontario and the 11th largest metropolitan area in Canada. With close proximity to the GTA, Michigan and New York state borders, and multiple Great Lakes, the region is well poised for future growth. It is the economic hub of southwestern Ontario, with major companies, hospitals, and higher education based in the city. For anyone familiar with London, the signs of new housing development are everywhere, with significant urban sprawl occurring throughout north and west London.

30 minutes south of London is St. Thomas, the seat of Elgin County. Ten minutes beyond St. Thomas, Port Stanley and other beach towns along Lake Erie offer recreational getaways for London locals. A similar drive west of the city are the towns of Komoka-Kilworth and Strathroy-Caradoc, with a short drive further to reach the shores of Lake Huron. East of London, in Oxford County, are the growing towns of Woodstock, Ingersoll, Tillsonburg, and Norwich. With both the 401 and 402 highways running along the southern border of London, surrounding Middlesex County and these neighbouring communities are easily accessible. For this reason, they can be considered part of the Greater London Area.

Greater London Area: Total Market Overview

Across all communities included in the GLA, the median sale price observed in the first quarter of 2023 was $590K, up 2.1% from the prior quarter but down 24% from the record period one year earlier.

Despite London homes losing roughly a quarter of their market value from the record peak in Q1-2022, in the broader context, London prices have experienced significant growth over the past 5 years, outperforming neighbouring markets like Brantford, Kitchener-Waterloo, Hamilton, and the GTA. This can be widely attributed to the relative affordability of London homes when compared to homes in these nearby markets. For the preceding 20 years, London prices have more or less lagged behind the growth experienced in these markets, and it appears that recently the Forest City has been playing a bit of catch-up. Compared to its trailing 5-year average for median sale price, London homes ended the year up 20%. To compare London’s performance against other major markets in the province, check out our article on Top Markets in Ontario here.

Part of what drove London’s phenomenal price growth during the pandemic was its low inventory, or housing supply available for buyers. To end the 2021 year, the Greater London Area had only 0.4 months of inventory, which meant that listed homes were selling in under two weeks on average. Without new homes hitting the market, London inventory would have disappeared in less than a month. When inventory levels are this low, prices have to rise on account of too many buyers bidding on too few properties. This leads to bidding wars and runaway prices, explaining part of why London prices are close to double what they were 5 years ago. Over the trailing 5 years, the GLA has been a tight sellers’ market, with an average of only one and a half months of resale inventory.

Throughout 2022, multiple interest rate hikes resulted in a temporary cooling of the market, with Greater London ending the year with almost 4 months of available inventory, up significantly from where it’s been since 2017. Homes were also taking much longer to sell, with a median days on market (DOM) of 25 days. During the first quarter of 2023, some buyers have started to re-enter the market and outweigh new sellers, with available resale inventory falling to 2.2 months and homes selling slightly faster at 22 median days on market.

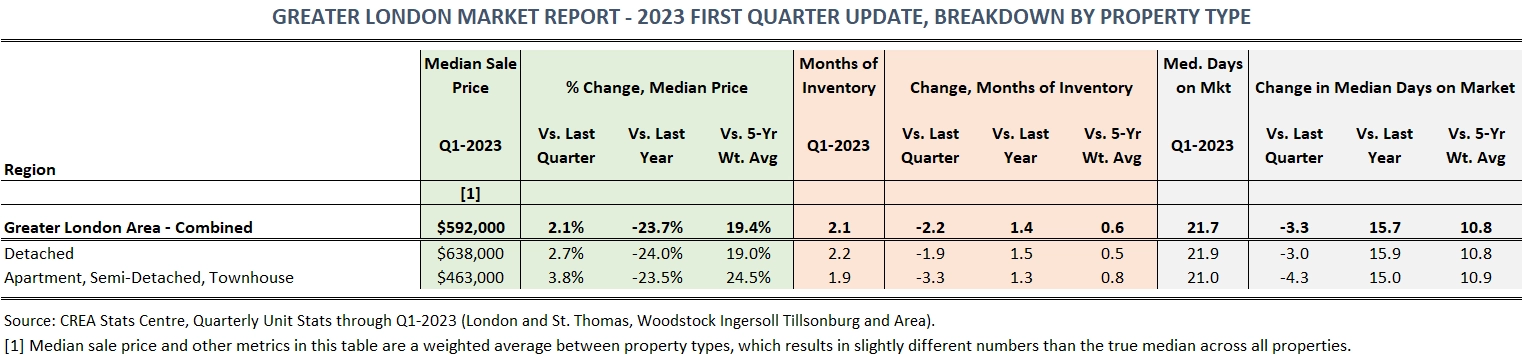

Most properties in the Greater London Area, about 3 out of 4, are detached homes. Detached homes in London, as expected, are more expensive than apartments and semi-detached properties, with median sale prices to end the year of $638K and $463K respectively. Over the past 5 years, detached homes in London have seen prices grow at a slower pace than the apartment segment, which has more than doubled in value since the first quarter of 2018. To end the year, both property types are taking around 21 days to sell, while resale apartment inventory - which at year-end 2022 was showing high supply levels - has been reduced to just under 2 months on account of increased buyer demand.

Community Overview

London North, South, and East

London East is bounded by the Thames River to the north and south, and to the west, where the river runs north-south through Western University and alongside Richmond Street, the main thoroughfare to downtown London. London South, similarly, is the portion of the city that is south of the Thames River and its downtown fork. Finally, there is London North, which is bounded to the south and east by the fork of the Thames. These three sub-regions each have multiple neighbourhoods within them, in total account for close to 60% of resale activity in Greater London. All three regions in London metro saw inventory fall in the first quarter, with homes also selling much quicker when compared to year-end 2022. That being said, when compared to one year earlier or the trailing 5-year average, inventory levels are healthier although still under 2 months of supply.

London East, historically and to this day, is the most affordable of the three regions, ending Q1-2023 with a median sale price of $455K. This area has the most diverse housing mix in the city, which includes historic luxury properties along the Thames River in Old North, an array of apartments and multi-units in the downtown core, and smaller, more affordable detached homes east of Adelaide. Given this wide-variety, it’s important to speak with a realtor knowledgeable in your preferred location and property type in order to get a better sense of what – and where – you may be able to afford. Of the three regions, London East reported the largest year-over-year price decline at 30% but is experiencing lower inventory levels than both London South and London North. Finally, London South ended the year with a median sale price of $580K, down 25% compared to one year ago but up 1.8% over the last 3 months. Prominent neighbourhoods in South London include Wortley Village, Byron and Springbank Park, and White Oaks.

Community Overview

St. Thomas and Elgin County

To end Q1-2023, St. Thomas and Elgin County reported a median sale price of $585K, down 20.7% year-over-year but up 29.1%, outperforming each of London’s three boroughs. After months of inventory steadily grew in 2022 to end the year with over 5 months of inventory, resale supply has tightened in 2023 and is now sitting at 2.5 months. With more spring buyers expected to re-enter the market and sellers more or less outnumbered, inventory should continue to decline through the second and third quarters.

Unlike London, homes in St. Thomas and Elgin County are still taking longer to sell, with a median listing period of 33 days, up nearly a week from the last quarter of 2022 and more than 26 days from the market peak a year prior.

Community Overview

Woodstock-Ingersoll

Woodstock-Ingersoll finished the first quarter with a median sale price of $603K, down 21.9% when compared to the record quarter one year ago. When compared to its trailing 5-year average, the median price is up 18.7% and performing more or less in line with the entire GLA.

A year ago, inventory levels in Woodstock were critically low, with only around 0.5 months of inventory (homes selling after 6 days on average). This supply-demand gap is why prices in Woodstock-Ingersoll were up 30% in 2021. The recent slowdown in sales activity has improved inventory levels in the region, finishing 2022 at just under 3 months of supply. However, Woodstock-Ingersoll is the only region in Greater London with material inventory declines over the last two quarters, down to only 2.3 months in Q1-2023 from 4.3 months in the third quarter of 2022. Inventory is what’s known as a leading indicator for price growth, with consistently falling inventory levels leading to upward price pressure. As we move through the second quarter of 2023, inventory levels throughout Woodstock-Ingersoll should be closely monitored by prospective buyers.

Community Overview

Tillsonburg & Area

Tillsonburg & Area ended the first quarter with a median sale price of $637K, down 20.1% for the year, although market conditions are shifting quickly. In 2022, inventory increased more than ten-fold, ending the year at 8 months, the highest level for all regions within Greater London. As expected in conjunction with this increased supply, homes were also taking much longer to sell, leading all GLA regions at 38 days. Through the first quarter of 2023, inventory has dried up to just under 4 months but homes are still taking a long time to sell at 44 days.

A final note regarding Tillsonburg & Area is that prices are drastically more expensive in the surrounding rural communities when compared to the town of Tillsonburg, which can result in large swings in average prices based on what type of properties sell during a specific time period. In the third quarter of 2022, close to 80% of homes sold were located in Tillsonburg or Norwich, resulting in a median sale price that was markedly lower than the price recorded in prior and preceding quarters, where only 70% of properties sold were located in these towns. As always, speak with a realtor experienced in your preferred location to get more refined estimates on how a specific neighbourhood may be shifting.

Community Overview

Surrounding Middlesex County

Surrounding Middlesex County, while only 5% of current resale activity, remains the most expensive market in Greater London, ending the first quarter with a median sale price of $743K. New housing development is rapidly progressing in many townships within this region, with most projects focused on single-family detached subdivisions with premium price points. Compared to a year ago, median prices are down 23%, with inventory levels falling back in line with the 5-year trailing average at roughly 3 months of available supply. When compared to the trailing 5-year average for median sale price, properties in surrounding Middlesex County are up 16.6%.

Community Overview

Strathroy-Caradoc

Strathroy ended the first quarter with a median sale price of $549K, down 30% year-over-year but up 11% when compared to the trailing 5-year average. Strathroy has experienced more stable inventory levels than other GLA regions, ending the year with 5 months of inventory, down to 3 months through the first quarter of 2023. When compared to its trailing 5-year average of 2.4 months of inventory, Strathroy is operating under relatively normal market conditions. Similar to other secondary markets in Greater London such as Middlesex County, St. Thomas, and Woodstock-Ingersoll, Strathroy homes are taking slightly longer to sell (~33 days) when compared to London proper (15-16).

Summary

The Greater London Market report will be updated on a quarterly basis. Every market is different, but understanding available inventory levels alongside recent price and market trends can help prospective buyers and sellers make more informed decisions. A summary of all London markets through the first quarter of 2023 is presented above and you can subscribe to quarterly updates of the London Market Report report by completing the contact form below.

Thank you for taking the time to read this article. As you contemplate the next steps in your real estate journey, there are a variety of helpful online resources you can leverage, such as realtor.ca, the Canadian Mortgage and Housing Corporation, and historical sales data and market insights from leading real estate websites like Zolo, Royal LePage, HouseSigma, and Wahi.